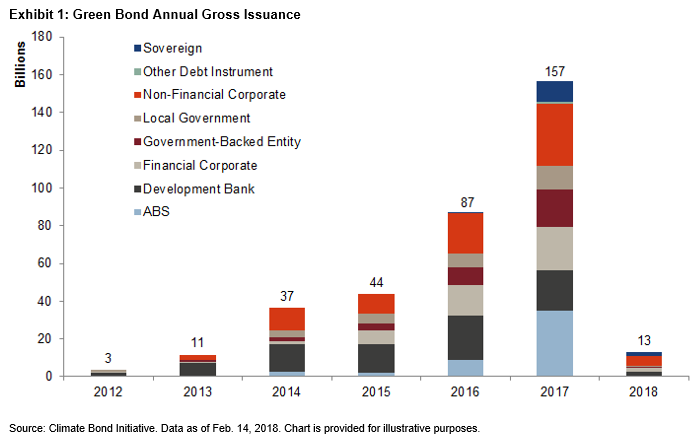

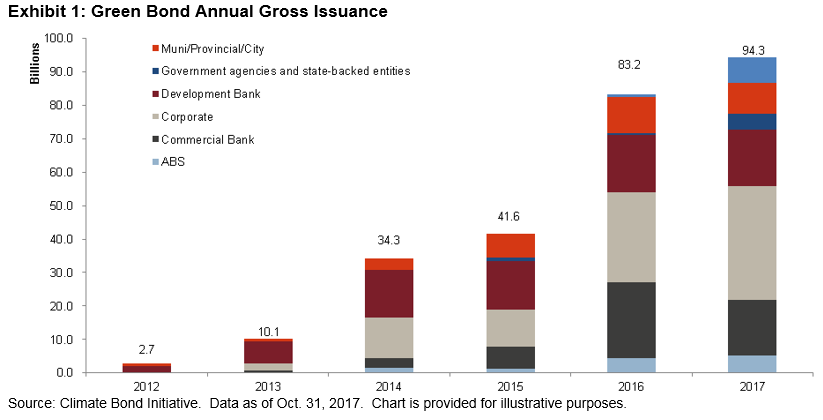

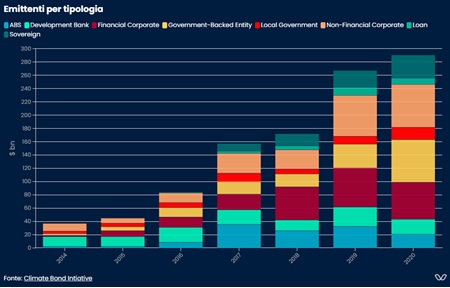

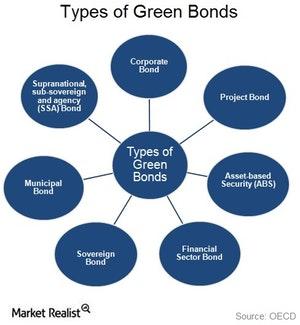

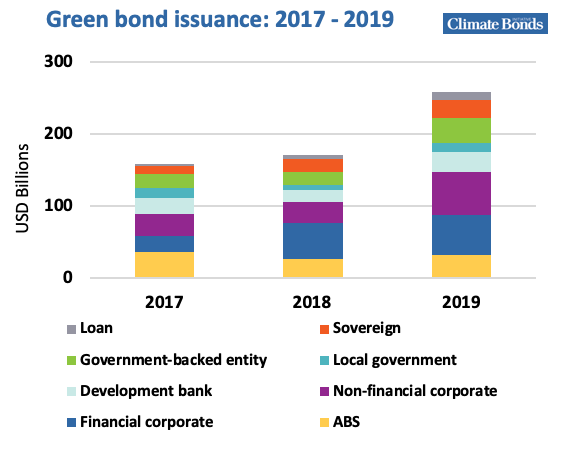

Growth in the labeled green bond market. Where, ABS stands for Asset... | Download Scientific Diagram

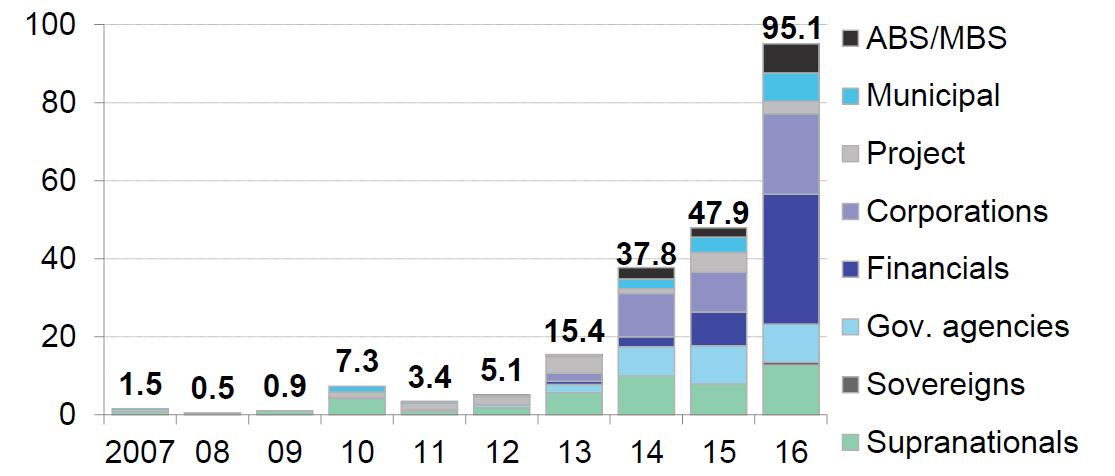

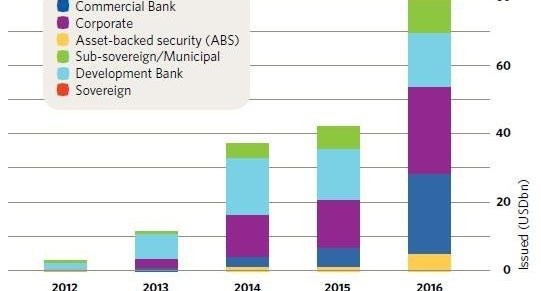

Green Bonds and Securitisation - Paving the Way towards Financing the Sustainable Transformation? - TSI kompakt

Growth in the labeled green bond market. Where, ABS stands for Asset... | Download Scientific Diagram

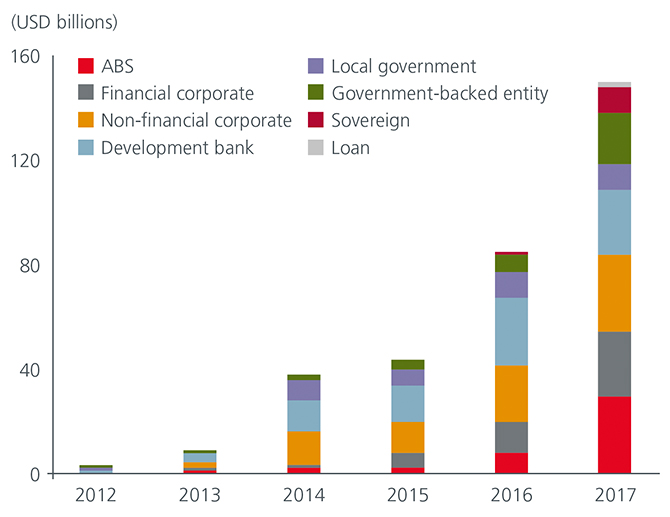

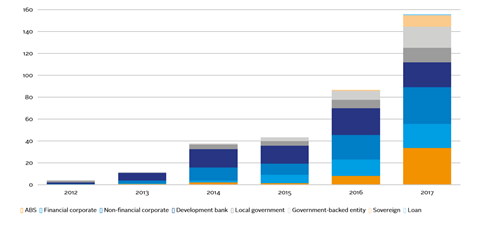

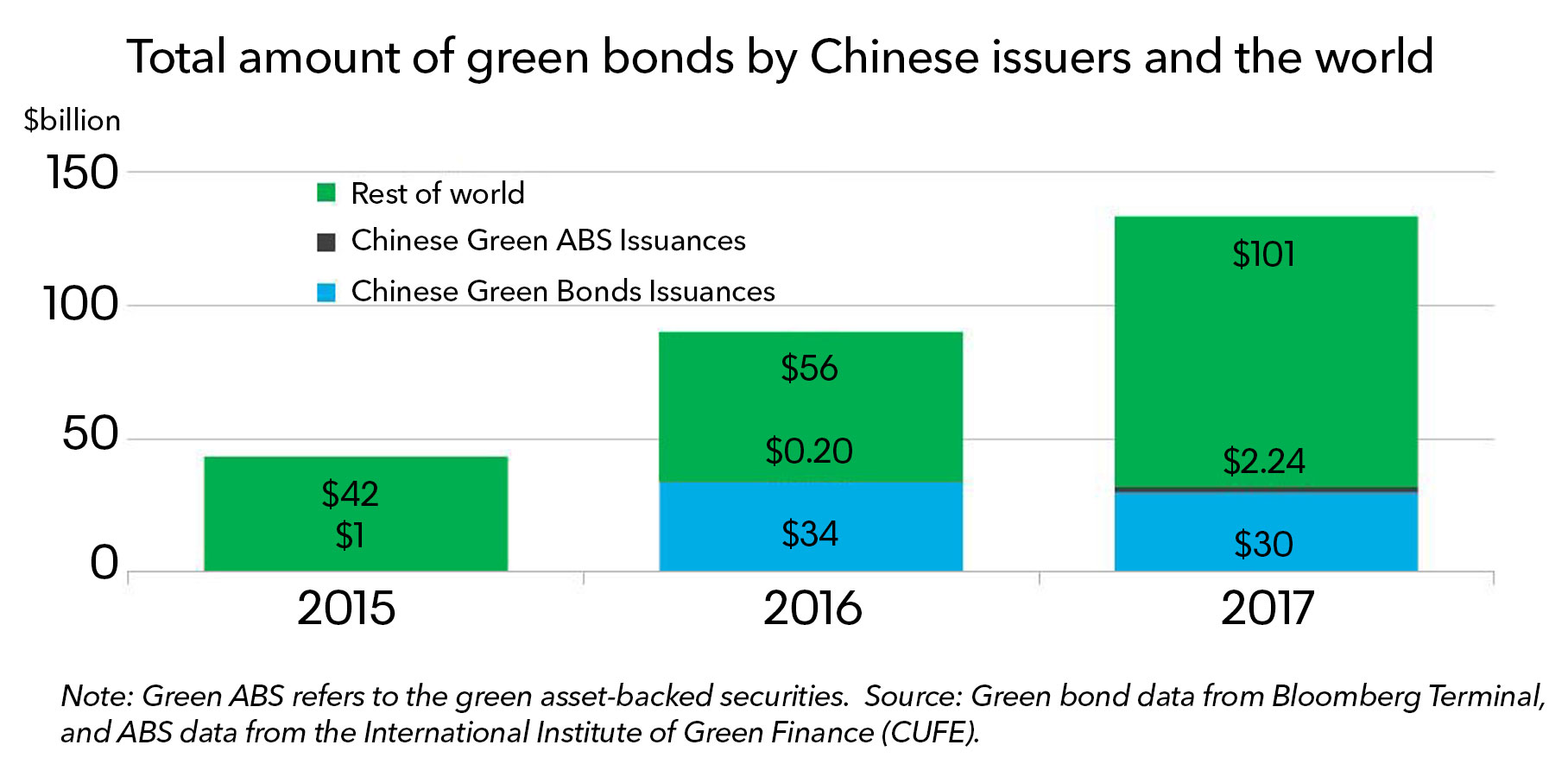

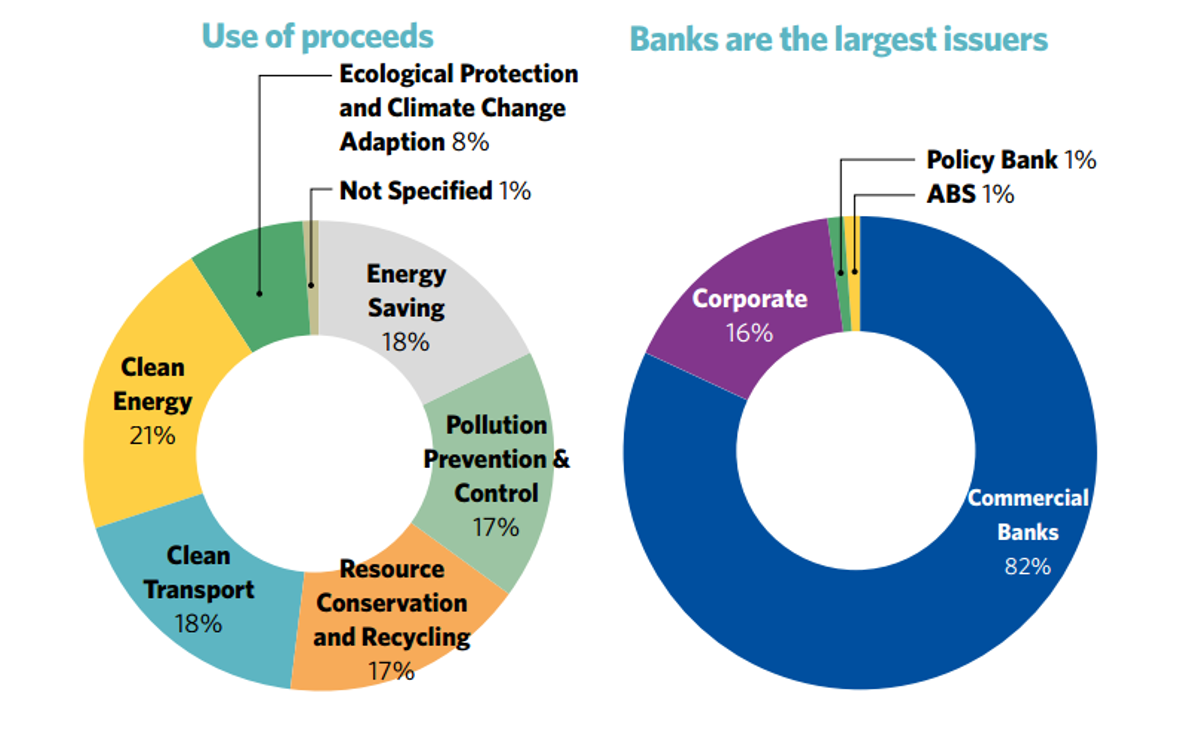

China Remains Largest Country-source of Green Bonds, with $30 Billion Issuances in 2017 | BloombergNEF

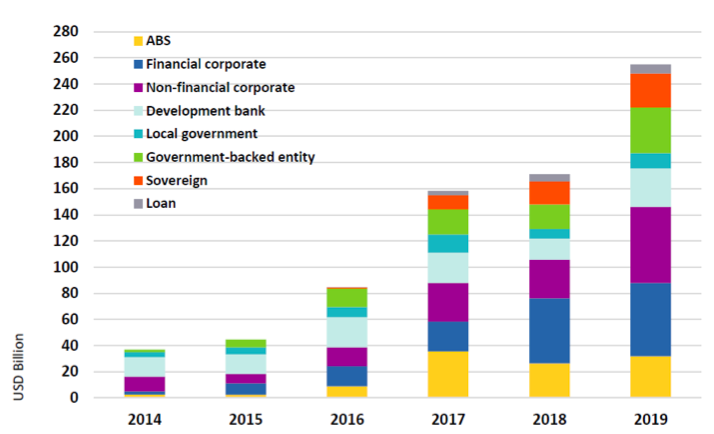

Climate Bonds on X: "From our new China #GreenBond Market Report: Developments in the profile of China issuers marked 2019, notably strong growth in issuance by non-financial corporates, increasing 54% YoY, accounting

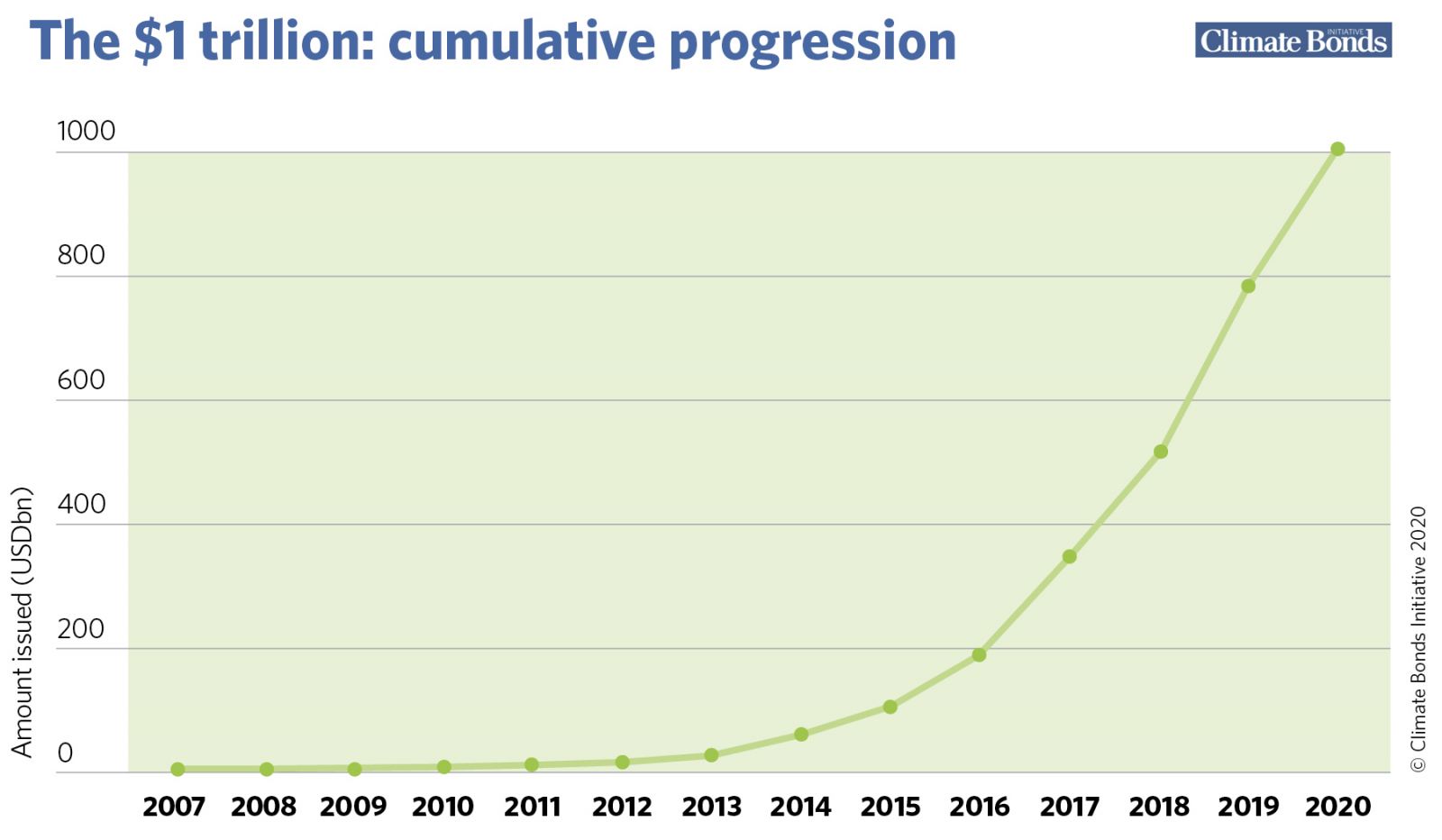

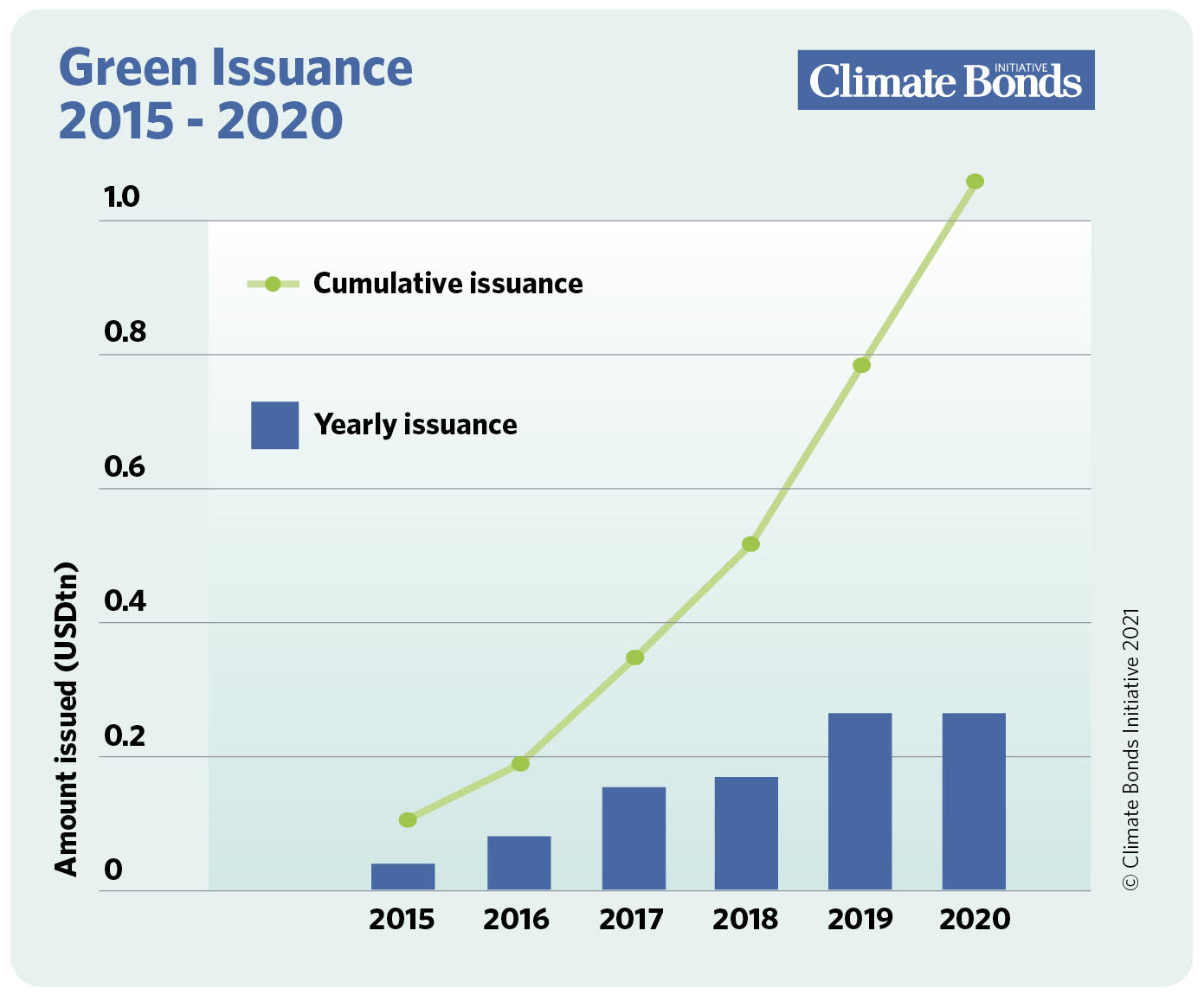

Record $269.5bn green issuance for 2020: Late surge sees pandemic year pip 2019 total by $3bn | Climate Bonds Initiative

China Takes Global Green Bonds Market by Storm – BRINK – Conversations and Insights on Global Business

:max_bytes(150000):strip_icc()/Green-Bond-final-07bf84e902a14fdf832b9c4bd5b272c4.png)